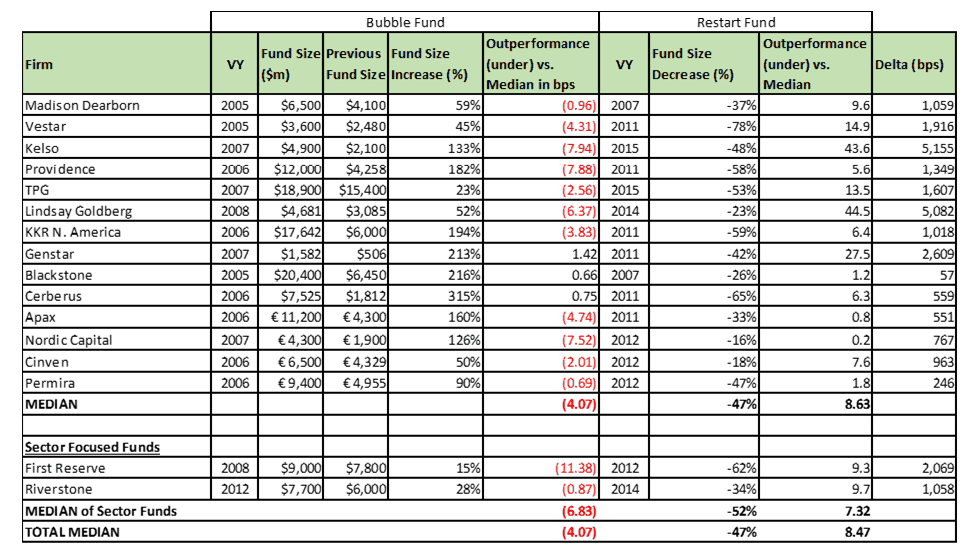

Source: Fund data – WSIB, CalPERS, CalPERS, CalSTRS, State Board of Administration of Florida, Colorado PERA, Wikipedia, other public sources; as of 12/31/17 – 9/30/18

Benchmark: Cambridge, as of September 30, 2018; benchmark matched to strategy

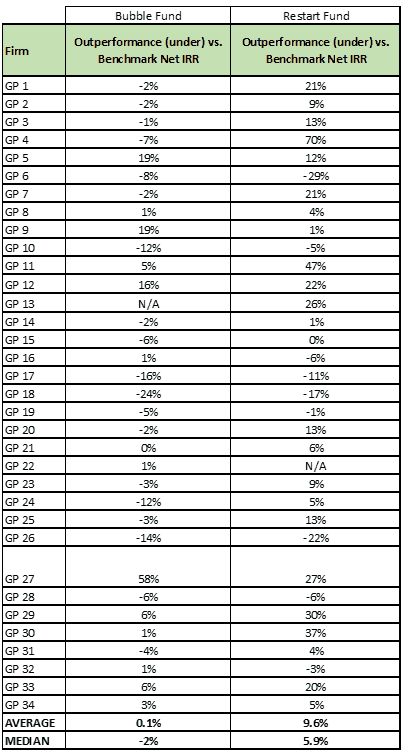

RCP Advisors, a fund-of-funds platform focused on U.S. lower middle market funds, ran a similar analysis among funds in their proprietary database with fund sizes of $2 billion or less. RCP found 34 funds that fit the “restart” fund parameters defined above. Each fund was at least 40% smaller than the previous larger fund. The chart below summarizes their findings. The spread between the median “restart” fund and the previous fund when compared to the median returns of the benchmark was 780 basis points in favor of the restart fund. The spread was even higher when comparing the average returns. While not shown in the chart below, the TVPI data also shows outperformance of restart funds over the previous funds when compared to a benchmark.

| Median Fund Size | Percent of funds above the CAM US Buyout Median | Median Outperformance above CAM US Buyout Median | Average Outperformance above CAM US Buyout Median | |

| Previous Larger Fund | $475 million | 45% | -1.9% | 0.1% |

| Restart Fund | $178 million | 71% | 5.9% | 9.6% |

Source: RCP, as September 30, 2018

Benchmark: Cambridge, as of September 30, 2018; benchmark matched to strategy

Source: RCP, as September 30, 2018

Benchmark: Cambridge, as of September 30, 2018; benchmark matched to strategy

The conclusion here should not be to commit to every “restart” fund and our findings should not be viewed as a recommendation to do so. Every situation is different. Some firms, despite raising a larger fund and underperforming, have no desire to change their behavior. Other firms continue to underperform for a host of reasons: the market has competed away their differentiation, the best investors have left the firm, and/or the market has changed and the firm refuses to adapt. Regardless, the data shows that outperforming funds that become underperformers deserve consideration. Hopefully this information will lead you to engage with a “restart” fund in your portfolio to determine whether making a new commitment makes sense, rather than dismissing it immediately.

Disclaimer: The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of Mr. Bradle’s employer, the State Board of Administration of Florida, or Mr. Abell’s employer, RCP Advisors.